Borrowers of Pagasa Philippines Finance Corporation (PPFC) and Pagasa Ng Masang Pinoy Microfinance Inc (PMPMI) have been asking the management to provide insurance to them since most of the MFIs operating in the Philippines have insurance.

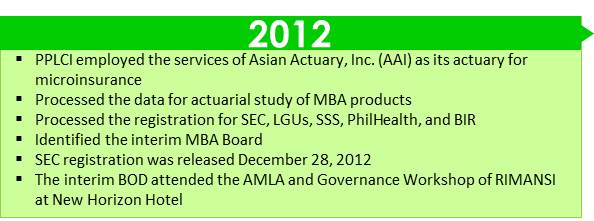

Year 2012 when the management of PPFC decided to pursue this cause and started exploring its option on how it can provide insurance to the borrowers. A partner-agent didn’t push thru due to the constraint of the product that it offers compare to the product that the management have in mind – a product that its’ borrowers will benefit a lot.

Thus, the management decided to put up its own Microinsurance Mutual Benefit Association (MI-MBA) last April 2012, named PagASA ng Pinoy Mutual Benefit Association, Inc. (PPMBAI). Since PPMBAI will be the microinsurance arm of the two companies thus the PagASA named was adopted and approved by all.

Securities and Exchange Commission (SEC) approved the license of PPMBAI last December 28, 2012 while Insurance Commission (IC) approved the license of PPMBAI last April 11, 2013. Upon approval PPMBAI started marketing its three (3) approved products namely: Basic Life Insurance Plan (BLIP), Credit Life Insurance Plan (CLIP) and Retirement Savings Fund (RSF). As of to date PPMBAI has a total membership of 140,000 household. Translating that figure into individuals, the association is serving 700,000 individuals assuming an average of five (5) members per household.